"Best free tools available for automatically saving money include automatic savings apps. They are designed to simplify budgeting and financial planning with their intuitive user interface and automated functionalities."

Automatic Savings Apps: Best Free Tools To Save Automatically

Automatic Savings Apps: Best Free Tools To Save AutomaticallyIntroduction

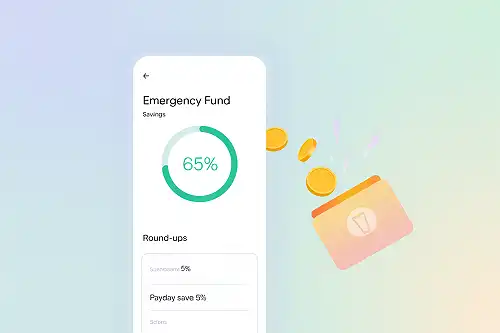

In today's financial landscape, managing savings can be streamlined through automatic saving apps. These tools automate the process of adding money to your bank accounts, helping you save without thinking. Whether you're looking to meet long-term financial goals or manage unexpected expenses, automatic saving apps offer a practical solution.

Best Free Automatic Savings Apps

1. Mastering Automatic Savings Apps

- Known for its user-friendly interface and comprehensive features, this app allows users to set multiple savings targets. It tracks your monthly savings goal and automatically contributes money to reach them. Features include automatic contributions (like employer matches or personal donations) and interest earning on each account.

2. Savings Goals Manager

- This app helps you save money by automating contributions from various income sources like employers, bank accounts, and retirement plans. It tracks expenses in real-time to ensure you're not overspending, making it ideal for long-term savings goals.

3. AutoSaver

- Perfect for those who want a simple way to add a fixed amount monthly or weekly without a financial institution. It offers customizable saving targets and interest rates tailored to your personal needs.

4. Budget Pro

- While not solely an automatic savings app, Budget Pro offers features like budget tracking and goal setting that complement automatic savings. It allows users to set multiple goals and track where their money is going, enhancing the effectiveness of their savings strategies.

5. Bank Account Savings

- This app automates contributions from your checking or savings account. It automatically adds a specified amount to your bank account monthly, quarterly, weekly, or daily, making it suitable for those who prefer consistency in savings frequency.

How They Work

Automatic saving apps work by tracking your income and expenses, setting monthly or yearly goals, and automatically contributing money where applicable. Some apps also offer interest earning on each account, helping you grow your savings over time. These features make them ideal for both regular savings and long-term financial planning.

Features to Look For in Automatic Savings Apps

- Multiple Savings Accounts: Many apps allow you to save money in multiple accounts, making it easier to reach different financial goals.

- Budgeting and Tracking: The ability to track expenses and ensure you're not spending more than you earn is crucial. Many apps offer tools for budget tracking and goal setting.

- Automatic Contributions: Features like employer matches or personal contributions are often included, helping you save without needing external funds.

- Interest Earnings: Some apps offer interest earning on each account, which can help grow your savings over time.

Conclusion

Automatic saving apps are powerful tools that can help you manage your money effectively. Whether you prefer a simple app for regular savings or a more comprehensive tool for complex goals, these apps offer flexibility and convenience. By exploring different options, you can find the best fit for your needs and goals. Start saving today—your savings will be there waiting for you!

------

#PersonalFinance #acorns #automaticsavingsapps #bestsavingsapps #chime #Digit #moneysavingapps #qapital #savingsapps